Change is coming to customs declarations!

Don’t be afraid we’re here to help.

Dating back, probably to when dinosaurs existed, there has been a licence waiver code (LIC99) which has been used on entries to avoid the need to declare licences and other associated document. When CDS replaced CHIEF, this was changed from LIC99 to 999L and is still currently in use.

However, from 1st Feb these will not be valid anymore and the correct licence code will need to be input where applicable – subject to the HS code and other contributing factors.

See the below information provided by HMRC:

Customs Declaration Service: Get ready for the removal of document code ‘999L’ for imports

On 14 Jul 23, we wrote to you to confirm that we had extended the use of waiver document code ‘999L’ on import declarations until 31 January 2024. After this date, the code will be permanently removed. This waiver document code is used for ex-heading goods, which are goods that may not have documentary or licensing requirements.

What you should use instead

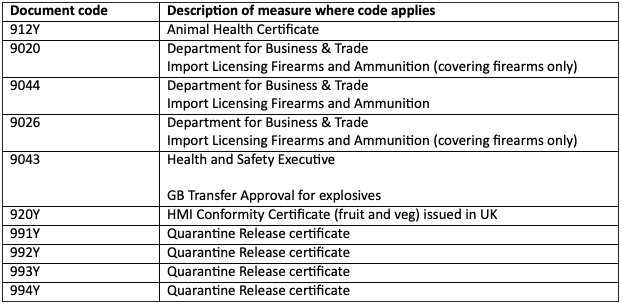

Ahead of 31 January 2024, we have published the following 10 national waiver document codes to the UK Tariff. These should be used instead of 999L when submitting your import declarations.

These national waiver codes are in addition to the EU waiver documents codes that should be used for other import measures. They are available within the Trade Tariff on GOV.UK.

You should start using these codes straightaway. If you use the 999L waiver document code for imports after 31 January 2024, your declaration will not be accepted. This means your goods being delayed at the border.

Pre-lodged import declarations made before 31 January 2024 that arrive after this date will be rejected unless the correct waiver document code has been supplied in place of 999L.

If you make import declarations on behalf of others, please make your customers aware of these changes. This will make sure they continue to provide you with the information needed for their declarations.

Help and support

Further information about these national waiver document codes, including how to use them, is available on GOV.UK

Please be aware that waivers can be added or amended to align with legislation. You can find the latest information explaining what the codes needed to import and export certain commodities on GOV.UK

For more information, you can:

- read the latest Customs Declaration Service guidance and access example import declarations on GOV.UK.

- watch our videos and recorded webinars on topics like imports, exports and rules of origin on the HMRC YouTube channel.